Renters Insurance in and around Milford

Milford renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Home is home even if you are leasing it. And whether it's an apartment or a townhome, protection for your personal belongings is a good idea, especially if you own items that would be difficult to fix or replace.

Milford renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Why Renters In Milford Choose State Farm

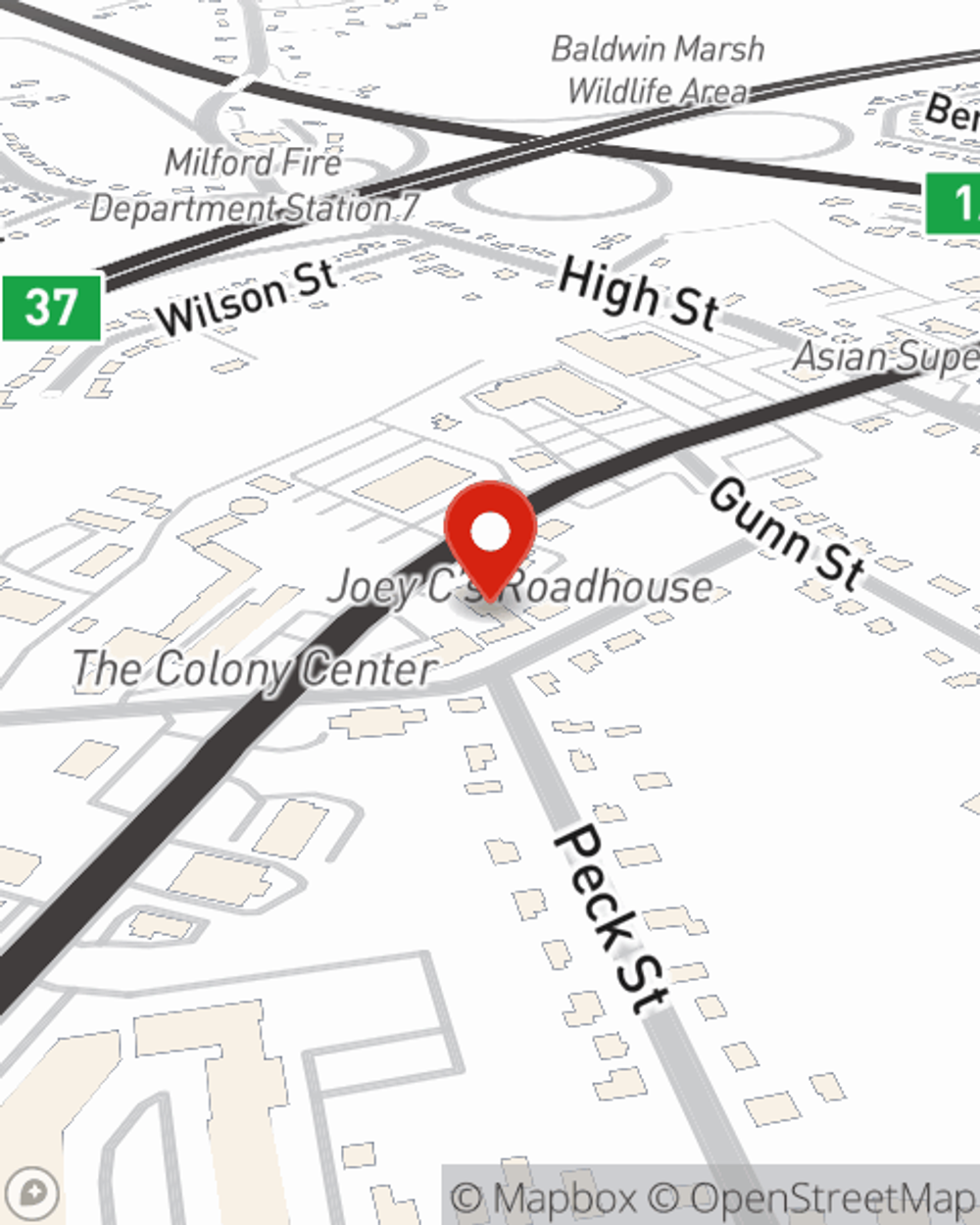

It's likely that your landlord's insurance only covers the structure of the apartment or space you're renting. So, if you want to protect your valuables - such as a desk, a set of favorite books or a set of cutlery - renters insurance is what you're looking for. State Farm agent Wanda Carlson is dedicated to helping you understand your coverage options and keep your things safe.

Don’t let worries about protecting your personal belongings keep you up at night! Contact State Farm Agent Wanda Carlson today, and explore how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Wanda at (203) 877-9203 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Wanda Carlson

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.