Life Insurance in and around Milford

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

Choosing life insurance coverage can be a lot to consider with many different options out there, but with State Farm, you can be sure to receive reliable empathetic service. State Farm understands that your end goal is to protect your family.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Life Insurance You Can Trust

Personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If tragedy strikes, Wanda Carlson is waiting to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

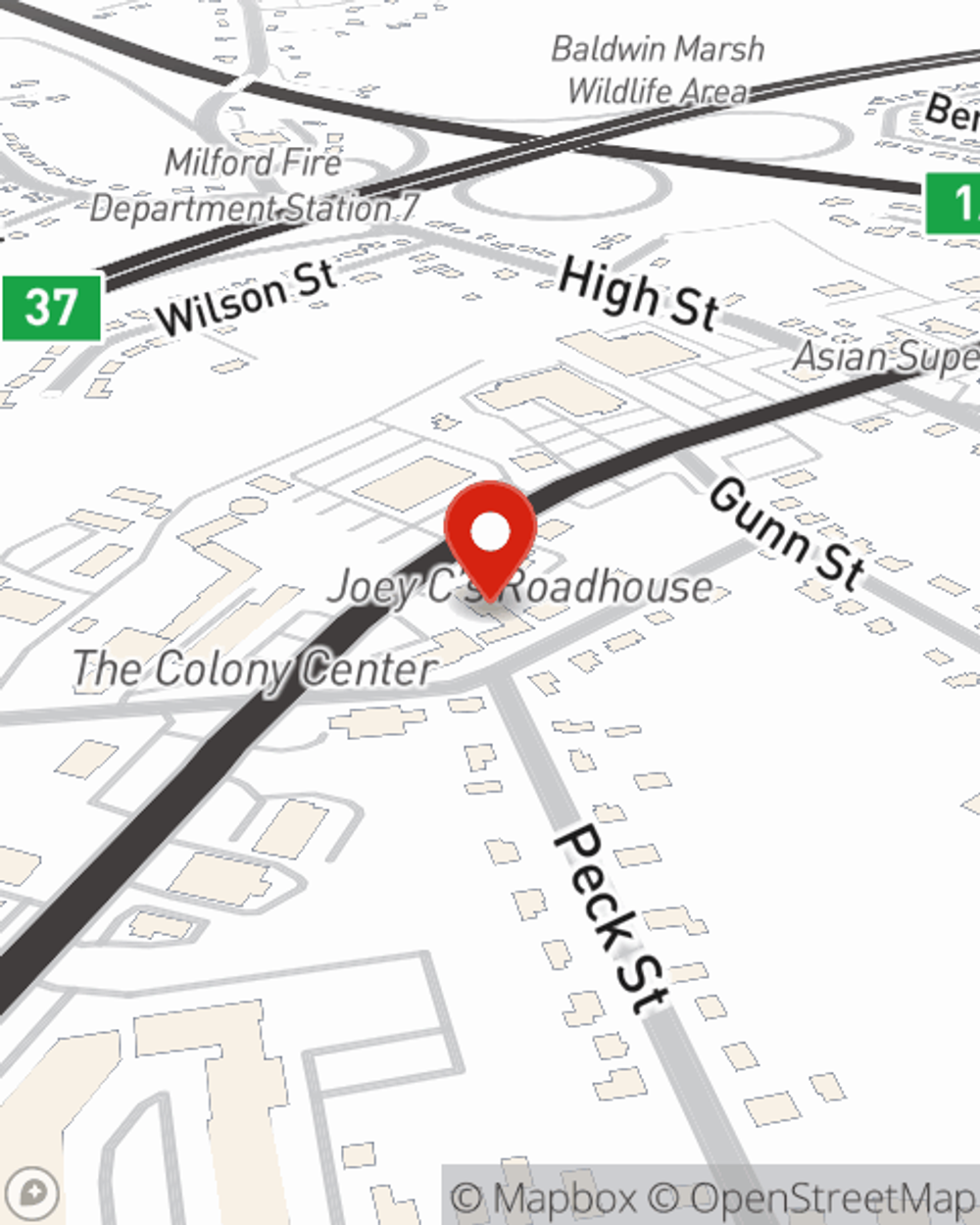

Reach out to State Farm Agent Wanda Carlson today to explore how the trusted name for life insurance can ease your worries about the future here in Milford, CT.

Have More Questions About Life Insurance?

Call Wanda at (203) 877-9203 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Wanda Carlson

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.